요즘들어 회사에서 제공하는 은퇴플랜들이 보편화가 되어가며, 많은 사람들이 은퇴저축을 계획하며 마주치는 장벽들이 있다. 바로 Pre Tax (Traditional IRA, Traditional 401k)로 저축할 것인가, 아니면 After Tax (Roth IRA, Roth 401k)로 저축할 것인가 이다.

어떤것이 더 좋은 선택인지를 정확히 알기 위해서는, 지금 당장의 세금혜택만 볼것이 아니라, 이 돈을 쓰게 되는 미래에 세금이 어떻게 적용이 되는지에 대한 전체적인 그림을 볼수 있어야 하고, 소득세의 계산법에 대해 잘 알아야만 명확한 답을 얻을 수 있다.

▶ 먼저 소득세 계산법에 대해 이해가 필요하다

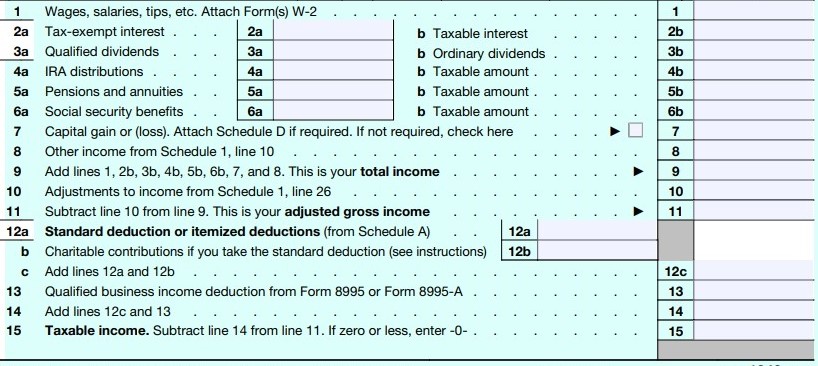

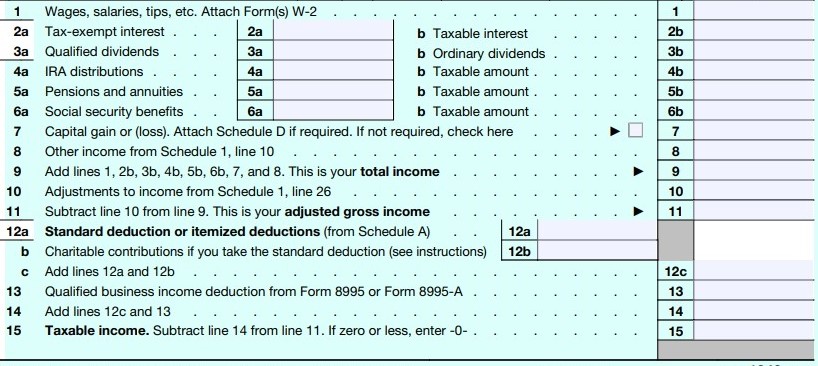

소득세는 크게 연방정부 소득세와 주정부 소득세가 있다. 물론 소득세가 없는 주에 산다면 연방정부만 계산하면 된다. 먼저 개인세금보고 양식 1040를 보면, 1번부터 8번 항목까지를 모든 소득을 더하여 Total Income을 정산하고, Schedule 1을통한 Adjustment를 계산하여 소득 공제 항목들을 뺀다. 그렇게 나온 금액을 11번 항목에 Adjustable Gross Income이라 한다. 그 이후 Standard Deduction또는 Itemized Deduction을 선택하는데, 대부분의 사람들은 Standard Deduction을 선택하는데, single인경우엔 12,950, Married Filing Jointly인 경우엔 25,900을 공제해준다(2022년도 기준). 그렇게 공제가 된 금액은 15번에 Taxable Income 즉 세금을 정산할때 사용하는 총 소득이 된다.

[FORM1040 - 2021]

Source IRS

쉽게 생각하여 대부분 결혼한 부부인경우, IRA나 다른 Deduction 없이도, 기본적으로 25,900불을 소득에서 공제하여 세금을 정산한다는 말이 된다.

또 이렇게 정해진 Taxable Income을 IRS에서 발행하는 Tax bracket에 적용하게 되는데 2022년도 Tax Bracket은 다음과 같다

[2022 Tax Bracket]

|

Tax Rate |

Taxable Income |

Taxable Income |

|

10% |

Up to $10,275 |

Up to $20,550 |

|

12% |

$10,276 to $41,775 |

$20,551 to $83,550 |

|

22% |

$41,776 to $89,075 |

$83,551 to $178,150 |

|

24% |

$89,076 to $170,050 |

$178,151 to $340,100 |

|

32% |

$170,051 to $215,950 |

$340,101 to $431,900 |

|

35% |

$215,951 to $539,900 |

$431,901 to $647,850 |

|

37% |

Over $539,900 |

Over $647,850 |

Source IRS

보다싶이 세금은 구간이 있어, (Married Filing Jointly인 경우) 첫 0불부터 20,550까지는 10%의 세금이 부과가 되고, 20,550이 넘어간 금액부터 83,550까지는 12%가 부과가 되고, 그 다음 구간또한 같은 방법으로 계산되어 총 세금이 계산이 된다.

▶ 그렇다면 이것이 은퇴플랜 저축과 과연 어떤 연관이 있단 말인가?

굉장히 큰 연관이 있다.

내가 저축하게되는 Traditional IRA, 401k등은 저축한 금액만큼이, 소득에서 공제가 된다. 그 말은 내가 저축하는 만큼이 내 Marginal Tax (내 Taxable Income중 가장 높은 Bracket에 해당되는 구간) 의 %로 세금이 절약된다는 말이다.

예를 들어 200,000이 소득인 가정에, Standard Deduction 25,900불을 제외하면 174,100의 Taxable Income이 되는데, 그렇다면 24%의 Marginal Tax인 것이다. 예를들어 10,000을 저축했다면, 10,000에 24%의 세금을 절세하는 것이다.

▶ 그렇다면 이 돈은 세금을 내지 않는것인가?

이 돈에 대한 세금은 돈을 꺼내 쓸때 그해의 소득으로 책정이 된다.

많은 사람들이 이 부분에 대해 헷갈려 하는데, 꺼낼때는 그 해에 꺼낸 만큼이 소득으로 간주가 되면, 세금에 대한 계산은 위에 말한것과 같이 소득세를 기준으로 계산이 된다.

가장 유리한 Traditional IRA 나 Traditional 401k의 활용법은 일하여 소득이 높은 시기에 높은 Tax 구간에서 절세를 하고, 나중에 은퇴 후 다른 소득이 없을때, 이런 플랜들에서 돈을 인출하여, 거희 세금을 안내거나 적게 내고 이 돈을 사용 하는 것이다.

여기까지만 이야기하면 Traditional IRA나 401k가 더 매력적으로 보이지만, 또 한가지 간과하지 말아야 할 사실이 있다. 바로 미래의 Tax Bracket이 어떻게 변할지 모른다는 것이다. 그렇기에 지금의 Tax Saving이 아무리 좋더라도, Roth IRA나 Roth 401k 같은 나중에 세금을 내지 않는 저축을 같이 하는것이 중요하다.

세금이 올라가더라도, Standard Deduction이나, lower tax bracket은 존재할 것으로 예상되기에, 만약 내 은퇴구좌가 Before Tax Money와 After Tax Money 두가지로 나뉘어저 있다면, 가장 유리한 고지에서 전략적으로 세금을 최소화 하며 피땀흘려 모은 은퇴자금을 가족들을 위해 더욱 사용할 수 있을 것이다.

하지만 Roth IRA는 고소득자들은 할수 없으며, 년간 저축 금액도 한도가 있고, Roth Contribution에 대한 401k company match는 Pre-tax로만 지급이 가능한 점, 그리고 Pre-Tax Account로 들어간 돈들은 After-Tax로 전환이 어려운 점 등을 생각해볼때, 저축을 시작할때부터 잘 결정해야하고 여러상황들을에 대해 잘 비교하고 고려해 봐야 한다.

내 은퇴 저축에 대해 진지하게 고민중이라면, 이런 여러 세법을 고려해 조언을 줄 수 있는 경험이 풍부한 공인재정상담가나 Financial Advisor에게 상담을 받는것을 추천한다.

Name: Matthew Kim

Tel: 818-319-0898

Email: matthewkim@allmerits.com

Website: http://blog.allmerits.com